child tax credit 2022 qualifications

To be eligible for this rebate you must meet all of the following requirements. To be a qualifying child for the 2021 tax year your dependent generally must.

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

The IRS deadline for the 2022 tax year is April 18 2022 you can file for the child tax credit when you submit your income tax return.

. Keep in mind that this is not a deduction. President Bidens 2 trillion Build Back Better social spending bill would have continued the the Child Tax Credit through 2022. Any age and permanently and totally disabled at any time during the year.

It is a now a fully refundable tax credit and you can qualify even if you had no earned income. The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements. The Child Tax Credit is intended to help offset the tremendous costs of raising a child or children.

The EITC is worth between 560 to 6935 in 2022 up from the 2021 EITC of between 543 and 6728. It is a credit. The recipient was only getting an amount of 1400 per child.

For each eligible child. As long as the child was not older than 17 by the end of the filing year they will qualify as part of the credit. There are several key differences between the expanded child tax credit parents enjoyed last year and the pared-back one that theyre settling for.

Taxpayers that qualify for the credit can claim a maximum of 2000 per qualifying child. A 2000 credit per dependent under age 17. Be under age 18 at the end of the year.

Parents income matters too. For Tax Year 2021 the credit can be worth up to 3600 per child in 2017 and earlier tax years the credit amount was 1000. The Child Tax Credit was only partially refundable prior to 2021 with this being up to 1400 per qualifying child and you needed at least 2500 of earned income to qualify for that.

Child Tax Credit For 2022. Under age 19 at the end of the year and younger than you or your spouse if you file a joint return or. The new child tax credit changes take effect immediately for your filed tax returns.

Due to the American Rescue Plan Act of 2021 the credit increased from 2000 per child to 3600 for children under 6 and 3000 for those aged 6 to 16. To be a qualifying child for the EITC your child must be. This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500 per qualifying child for children aged six to 17.

Not only that it would have modified it to include the following. You andor your child must pass all seven to claim this tax credit. The earned income tax credit is available to taxpayers with low and moderate incomes.

In most cases a tax. With the new child tax changes you can take advantage of the broader eligibility requirements and the credit amount per child has now doubled. The credit decreases the amount of tax you owe and the credit is refundable you.

You must be a resident of Connecticut. According to the IRS website working families will be eligible for the whole child tax credit if. Your AFNI is below 32797.

There was a partial refundability in child Tax Credit till 2020. 5903 per year 49191 per month Your AFNI is. Latest on Child Tax Credit Payments Cola 2022 IRS Tax Refunds.

Use our child tax credit calculator to determine your eligibility for tax year 2020 or tax year 2021. Under 6 years of age. A 70 percent.

Stimulus Check Updates Stimulus Check Updates. What youll get The amount you can get depends on. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States.

An increase in the maximum credit that households can claim up to 3600 per child age five or younger and 3000 per child ages six to 17. You might be able to apply for Pension Credit if you and your partner are State Pension age or over. November 3 2021 Tax Credits.

The Child Tax Credit was instilled to assist parents with offsetting the costs associated with raising children. A childs age determines the amount. Claim the credit right on Form 1040 and add Schedule EIC if you have children.

For the 2021 tax year that aid package upped the 2000 child tax credit to 3000 per dependent ages 6 to 17 and from 2000 to 3600 for children age 5 or younger. Further to get the benefit the taxable person should have at least 2500 as earned income. For more information see Disability and Earned Income Tax Credit.

Length of residency and 7. You get the maximum payment for all the children and your payment is not reduced. They earn 112500 or less for a family with a single parent commonly known as Head of Household.

6997 per year 58308 per month aged 6 to 17 years of age. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Meet all 4 tests for a qualifying child.

They earn 150000 or less per year for a married couple. You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children. You must have claimed at least one child as a dependent on your 2021 federal income tax return who was 18 years of age or younger.

Severely disabled child rate. Tax credits reduce the amount of tax you pay. Income thresholds of 400000 for married couples and 200000 for all other filers single taxpayers and heads of households.

For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17.

Ertc Deadline For Rebates Free Eligibility Test How To Claim Your Tax Credits In 2022 Tax Credits Rebates Tax Free

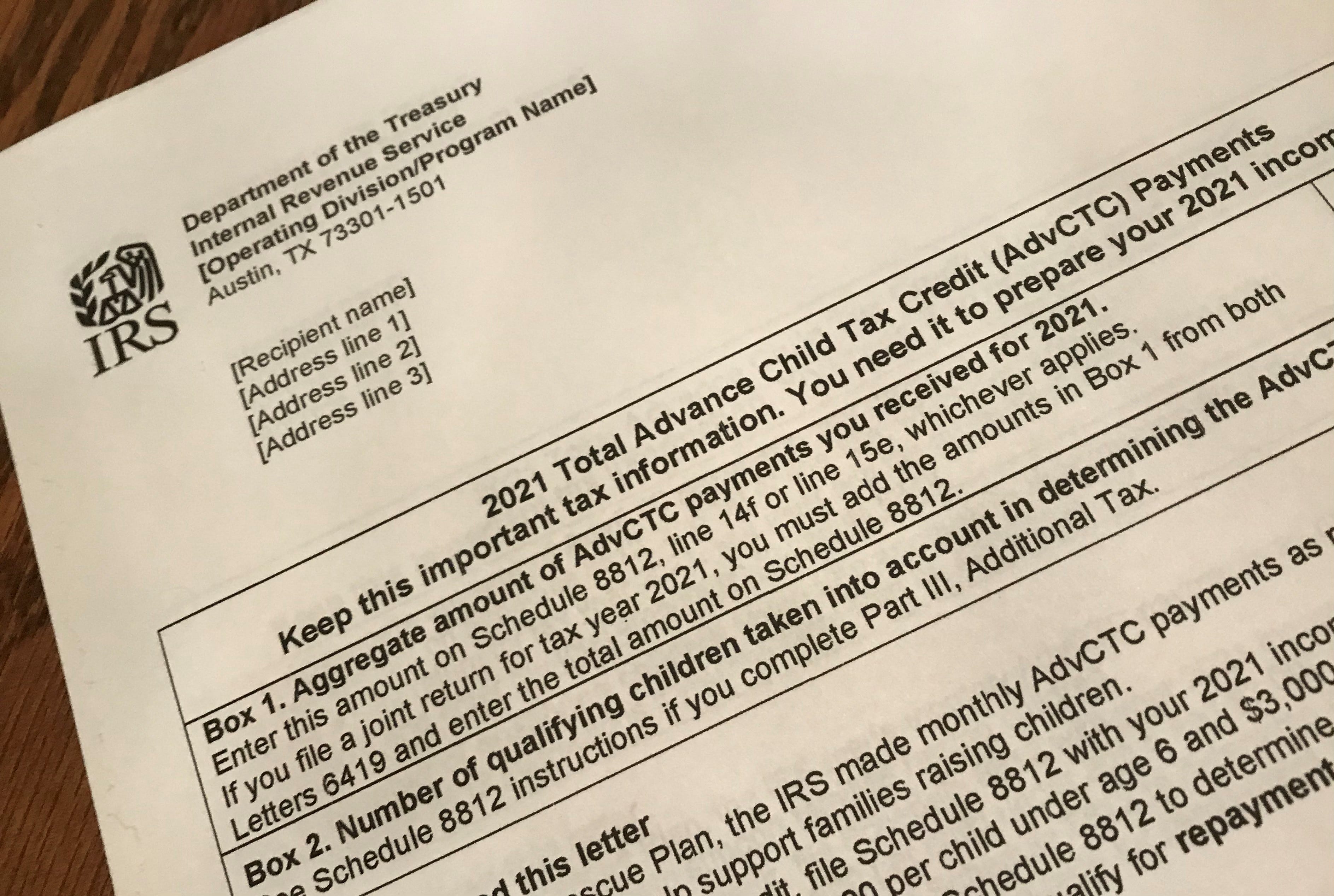

2021 Child Tax Credit Advanced Payment Option Tas

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

The Qualification Process Of R D Tax Credits In 2022 Tax Credits Qualifications Tax

The Child Tax Credit Toolkit The White House

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

Child Tax Credit Definition Taxedu Tax Foundation

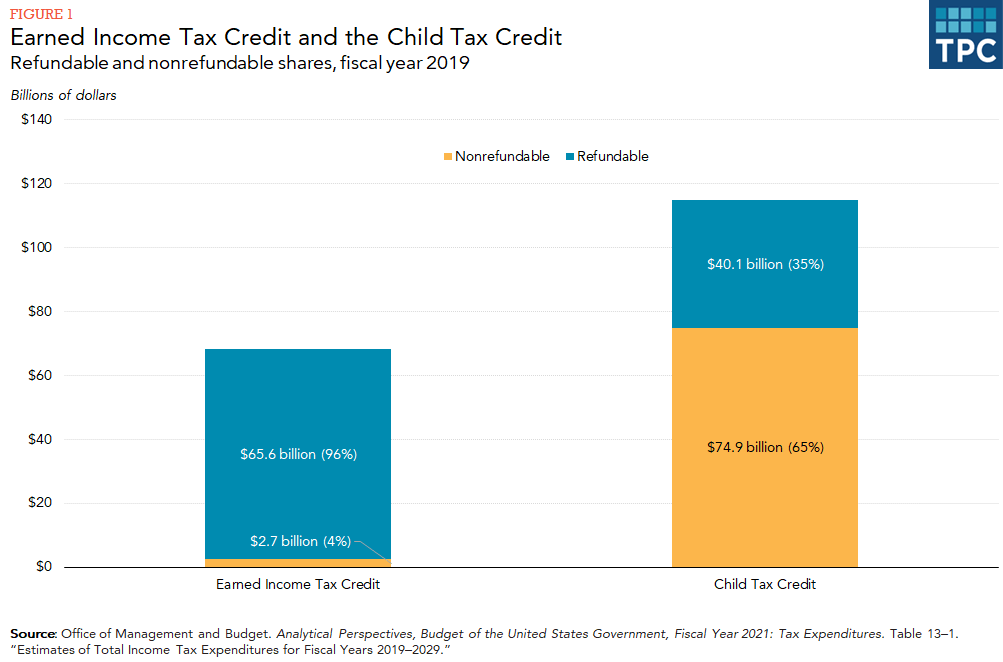

What Is The Difference Between Refundable And Nonrefundable Credits Tax Policy Center

The Child Tax Credit Toolkit The White House

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Child Tax Credit Definition Taxedu Tax Foundation

Input Tax Credit Itc In Gst Meaning How To Claim It And Examples In 2022 Tax Credits Tax Indirect Tax

Childctc The Child Tax Credit The White House

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger